How is Indianapolis Doing?

The COVID-19 pandemic has impacted nearly every aspect of life in American cities for the past two years. Indianapolis is no exception. Beyond the devastating loss of life and lingering health effects for our friends and neighbors, the pandemic upended our economy, daily routines, and many other facets of life.

This project tracks the ongoing pandemic recovery in Indianapolis with regularly updated visualizations on some of the most pressing and challenging issues in our community.

This project was inspired by The City, based in New York City. Special thanks to our intern team of Aravind Chintalapudi, Sai Chirag, Ted Deitz, Veena Mahesh, and Shruti Mukadam for their work to keep this data updated.

Subscribe to our substack for monthly updates on how these indicators are changing.

Unemployment Rate

The COVID-19 pandemic created one of the biggest global economic downturns in history. The stock market crash of 2020, supply chain disruptions, and general economic uncertainty led to layoffs at an almost unprecedented rate. The overall US unemployment rate peaked at 14.7 percent in March 2020 near the pandemic’s beginning and has just recently returned to the pre-pandemic (February 2020) rate of around 3.6 percent.

Through much of the recovery, Indianapolis’ unemployment rate was lower than the nation’s. It increased in spring 2022, but this was because more people joined the labor force, not because people lost jobs.

LATEST UPDATE: 03/25/25

Indianapolis’s unemployment rate has slight drecrese fom 4.1% in November to 4.0% in December of 2024. The nationwide rate is increased slightly from January’2024 to January’2025 from 3.7% to 4%.

Data for January 2025 for Indianapolis is not available as of yet.

Unemployment Rates since January 2019

Indianapolis and United States

Number of Employed Persons

The recovery from the unemployment high of 14 percent in April 2020 was slow and steady. Indianapolis gained jobs each month between May and August of 2020. Job growth stalled during the winter of 2020-2021, but was steady during the spring and summer of 2021, finally hitting pre-pandemic levels in July 2021. However, another decline occurred in September 2021 as the Delta variant caused a peak in COVID-19 cases, resulting in 3,000 lost jobs.

Since then, despite the Omicron variant causing the highest case number peak in the winter of 2021-2022, job growth has been steady.

LATEST UPDATE: 03/25/25

The latest data from BLS shows Indianapolis lost over 4779 jobs in December 2023 and further gained 59677 jobs in December 2024. Since the beginning of 2024, there has been a small increase in the number of employed people.

Data for Jan 2025 is not available as of yet.

Monthly number of employed people compared to February 2020

Indianapolis

Monthly change in employed people

Indianapolis

Employment in Key Sectors

Not all sectors of the economy were impacted equally. Many people decided to stay home more than they had before COVID-19, causing sectors like online shopping to boom while sectors like hotels and air travel (‘Leisure and Hospitality’ on the chart below) struggled.

If you’d like to know more about the sectors and the types of jobs included in each, you can look at the groupings here.

LATEST UPDATE: 03/25/25

March 2025: Bureau of Labor Statistics sector employment numbers

Employment in construction continues to surge and employment in informatics continues to decline when compared to pre-pandemic levels. Other Services have also recently surpassed the pre-pandemic 5-year average, and continue to grow with more employment opportunities.

MArch 2025 Employment in Key Sectors Compared to Pre-Pandemic 5-Year Average

Indianapolis Metro Area

Housing Prices

Even if you were not house hunting during the past few years, you have no doubt heard about the difficulty in finding affordable housing. It is a nationwide problem that hit Indianapolis hard. The median home price in the Indianapolis metro area increased by over $60,000 between 2020 and 2022. Prices have become so high that for the first time since the Federal Reserve Bank of Atlanta began their affordability index in 2014, the Indianapolis Metro Area has been designated as an “unaffordable” housing market.

LATEST UPDATE: 10/07/24

The Indianapolis metro area saw a decline in median house prices in August 2022 for the first time in nearly a year. After gradually increasing again in January 2023, prices declined again in August 2023, and continued to decline until January 2024. Currently, the median housing prices are around $280k.

Data for April 2024 is not available as of yet.

Median Home Price

Indianapolis Metro Area

How Long are Houses on the Market?

In addition to rising prices, homes are also listed on the market for much shorter periods than in previous years. While the specific number of days is highly cyclical, the downward trend both nationwide and in Indianapolis is clear.

LATEST UPDATE: 03/25/25

Indianapolis saw a slight increase in Februray 2025 for median days on the market when compared to Februray 2024, from 59 to 63 days. There was also a increase nationwide from 61 to 66 days on the market.

Since August 2022, Indianapolis had an increase in median days on market, from 36 to 57, and from 43 to 61 days nationwide since May 2022.

The data for March 2025 is not updated.

Median Days on Market for Residential Property Listings

Indianapolis Metro Area

Monthly Rent

Not everyone owns a home. One third of Central Indiana households rent, and rent has also been increasing over the past few years, albeit at a much slower pace than home prices. Rent increased 1.2% per month in 2021, compared to just 0.3% per month in 2020.

If you’d like to compare rents in Central Indiana to other metros, see Apartment List.

LATEST UPDATE: 03/25/25

Central Indiana’s average monthly rent has fluctuated from September 2022 to February 2023, but has been slowly and steadily increasing since February 2023, and currently hovering around $1,250 per month.

The data for March 2025 is not available yet.

Average Monthly Rent

Indianapolis Metro Area

Gas Prices

The discussion about inflation in the U.S. economy has dominated news coverage during the pandemic and has topped the list of American’s concerns recently, as tracked by Gallup. Inflation is driven by pandemic relief funding, disrupted supply chains, and Russia’s attack on Ukraine. For many consumers, gas prices were the most obvious sign of price increases.

Gas prices have risen everywhere in the country, but in Indiana our especially high gas taxes have combined with inflation to produce particularly high prices. Recent months have finally shown a decline in prices.

The figures below show prices in Indianapolis compared to one month and one year ago at this same time.

Gas Prices

Indianapolis, as of 07/31/24

LATEST UPDATE: 10/07/24

Gas prices have slightly decreased, with the current average price about 0.18 cents less when compared to this time last month. Prices are also about 0.18 cents lesser than a year ago

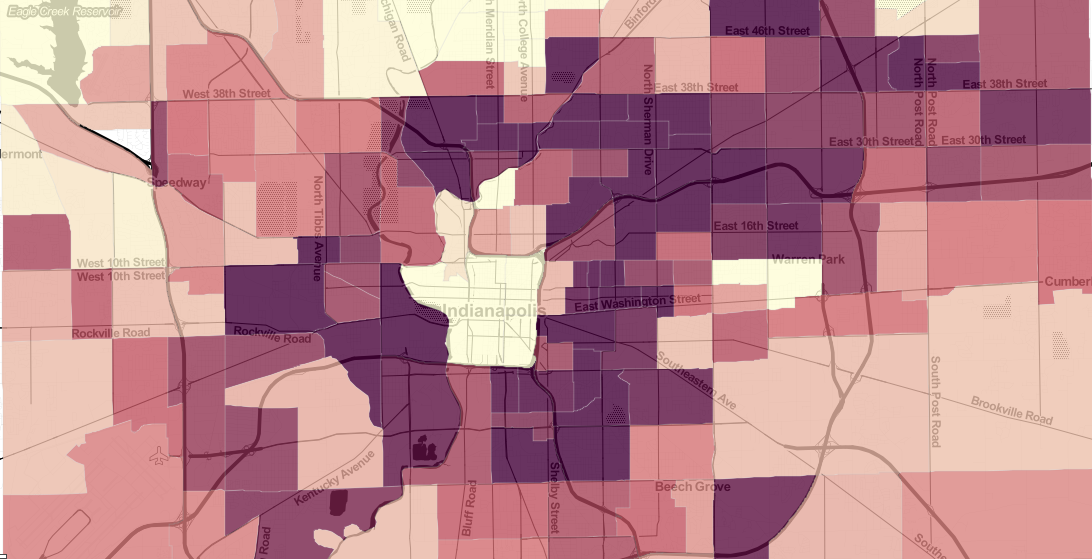

Equifax Subprime Credit Population for Marion County, IN

The COVID-19 pandemic has reshaped life in Indianapolis, leaving its mark on the economy and the financial well-being of many residents. A crucial indicator of this financial health is the percentage of the population in Marion County with a credit score below 660, often classified as subprime. Tracking this metric provides insight into the financial challenges facing our community during these tumultuous times.

The data shows that from 2014 to early 2020, the percentage of the Marion County population with subprime credit slowly declined, from around 37% to 33%. This trend reflects a gradual improvement in financial stability over the years. However, the pandemic disrupted this progress.

During the height of COVID-19 in 2020, the percentage of individuals with subprime credit decreased, hitting a low of 30.2% by April 2021, likely due to stimulus packages, financial aid, and deferral programs providing temporary relief. Yet, as these measures subsided, subprime rates began to rise again, reflecting the ongoing financial hardships many face.

LATEST UPDATE: 10/07/24

As of April 2024, the subprime credit rate stands at 31.34%, indicating a slight increase from that of April 2024 This uptick suggests that financial difficulties remain a reality for many.

Data for the next quarter is not available as of now.

Equifax Subprime Credit Population for Marion County, IN

Market Hotness Index

The COVID-19 pandemic had a significant impact on the real estate market in Indianapolis-Carmel-Anderson, Indiana. The market’s balance of buyers and sellers fluctuated dramatically, reflecting changes in consumer behavior, financial stability, and supply chain disruptions. In early 2020, the market faced uncertainty, with shifts in the index mirroring the broader economic turbulence.

Throughout the pandemic, the Market Hotness Index for Indianapolis-Carmel-Anderson saw notable fluctuations. In March 2020, the index spiked to 63.55, indicating a “Warm” market, as people rushed to secure homes, potentially spurred by low-interest rates and government stimulus measures. However, subsequent months saw varying levels of activity, with the index fluctuating between 40 and 70, indicating periods of both increased and decreased demand.

By 2021, the market showed signs of cooling down, with the index dipping as low as 43.48 in February. This trend reflects the pandemic’s prolonged impact on the real estate market, with changing consumer priorities and economic uncertainties influencing buying behavior.

LATEST UPDATE: 10/7/24

As of July 2024, the Market Hotness Index for Indianapolis-Carmel-Anderson ranks at 50.12, reflecting a cooling trend compared to previous years. This ranks the metro area #153 out of 300 metros nationwide, indicating a “Warm” market that has cooled down compared to the previous year.

The median days on the market stand at 59 days, with inventory moving 0% “Faster” than last year and 2 days “Faster” than the US overall. This indicates a relatively stable market in terms of turnover rate, despite the cooling trend. Additionally, properties in the area receive an average number of views 1.1 times “Higher” than the US average, suggesting sustained interest in the region’s real estate.

The data for Oct 2024 is not available yet.

Market Hotness Index

Public Transit Usage

Public transit ridership has been down nationwide since the onset of the COVID-19 pandemic. Fears of contracting the virus from sitting in close proximity with other riders, the increase of work-from-home arrangements, and other potential factors pushed transit agencies into a new era of public transportation. In Indianapolis, IndyGo is in the midst of major upgrades to the transit system through the installation of Bus Rapid Transit (BRT) lines. Below, you can see IndyGo ridership systemwide and by route compared to both the particular month in 2019 and also year-to-date compared to this point in 2019.

Although ridership has dipped for nearly every route, the Red Line has seen an increase since 2020. (The Red Line opened in September 2019.)

LATEST UPDATE: 10/07/24

March 2023 saw the highest rate of ridership since the onset of the COVID-19 pandemic in March 2020. Usage was up to 616k passengers. Ridership in June of 2024 went up from June 2023 by about 73k passengers but was over 232k more than in December of 2022.

Additionally, IndyGo has stopped publishing Individual Route Ridership data since November 2023.

Total Monthly Ridership

Office Occupancy

By now you’ve probably read an article or two about how downtown office buildings are struggling to return to pre-pandemic levels of usage. Kastle Systems, an office facility security provider, tracks how many people are swiping their key cards to enter office buildings in major metro areas. Nationwide, the weekly average share of employees going into the office has hovered around 40 to 45 percent of pre-pandemic levels.

While we don’t have that data available for Indianapolis, real estate firm Cushman & Wakefield does publish quarterly reports on the office building market for our metro area. Their reports track two key indicators for the health of the office market: vacancy rate and net absorption rate. Vacancy rate is the percentage of office building square feet that could be occupied, but is not. Net absorption shows whether there has been more square footage leased than vacated, resulting in a positive rate. A negative net absorption rate means that more square footage has been vacated than leased.

Indianapolis Metro Area: Office Real Estate Indicators

LATEST UPDATE: 10/07/24

In Q2 2024, net absorption was -60K SqF in the Northeast and -53K SqF in the South. Despite strong leasing activity in the Northwest, Keystone, and Midtown submarkets, current tenants vacating their space offset and outpaced any new leases in downtown Indy and overall in the Indy metro area.

Public University Enrollment

The COVID-19 pandemic has affected higher education significantly, altering enrollment patterns and prompting shifts in student behavior. Public universities in Indiana have experienced declines in enrollment across all terms, reflecting both immediate and long-term impacts. Factors such as online learning, changes in financial situations, and evolving academic priorities have influenced these trends.

Public university enrollment in Indiana has steadily declined since 2018, but the pandemic accelerated this trend. In 2020, enrollment stood at 62,297 students, followed by a sharp decrease to 59,869 in 2021, reflecting a significant impact of COVID-19 on higher education. This downward trend has continued in subsequent years, highlighting the challenges universities face in attracting and retaining students.

LATEST UPDATE: 10/07/24

Spring 2024: As of 2024, the total enrollment for public universities in Indianapolis is 23,824 students, based on spring data. This indicates a continued decrease from previous years, with factors such as shifting student preferences, financial constraints, and hybrid learning models likely contributing to the trend. The declining enrollment underscores the need for Indiana’s public universities to adapt to changing educational landscapes and student demands.

Data for Summer and Fall are not available.

Public University Enrollment Rates

Homicides

Murders increased 27% in 2020 nationwide, the largest single year jump in over 60 years. Then, in 2021, they increased again. In 2022, homicides have actually been declining around the country. Here in Indianapolis, there has been an intense focus on the murder rate and increase in violent crime locally. 2021 had the highest number of homicides in the city’s history, but things started to trend downward in 2022.

*Previous versions of these charts were sourced from IndyStar, which is no longer tracking the total number of homicides by year. As a result, we now source from WRTV, which has slightly different numbers but trends remain the same.

LATEST UPDATE: 10/07/24

2024 has shown a decline in homicides per 100,000 people when compared to previous years. The monthly average number of homicides per 100K has been improving since 2021, with 2024 recording the lowest so far since 2019.

Homicides by Year, per 100,000 population

Marion County, Indiana

Monthly Average of Homicides per 100,000 Population

Marion County, Indiana

Subscribe for updates

We will continue to update this page as new data becomes available and add metrics important to the city’s recovery over time. If you’d like to receive monthly updates on each of these measures in your email inbox, subscribe below.